NewRetirement, an innovative fintech company, is poised to transform how individuals plan for their retirement through a comprehensive, holistic approach. The traditional way of retirement planning often focuses solely on financial aspects, neglecting other crucial factors like health, lifestyle, and personal goals. However, NewRetirement believes that these elements are intrinsically linked and should be considered in conjunction with each other to produce a well-rounded retirement plan.

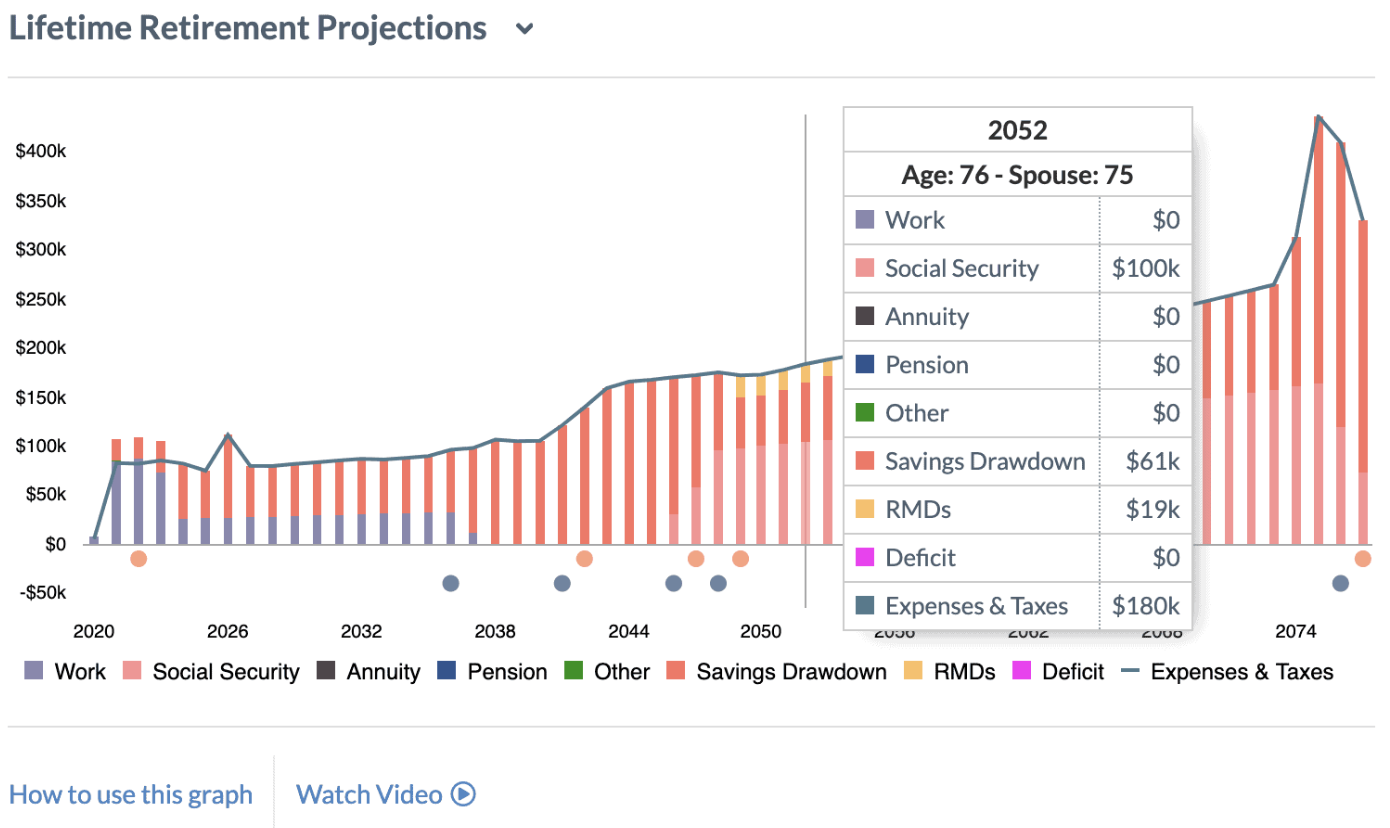

The company’s toolset is designed to help its users create a personalized roadmap that integrates all these factors. It allows users to visualize various retirement scenarios, calculate potential outcomes, and adjust their plans in real-time based on their changing circumstances and aspirations. This approach empowers individuals to make informed decisions and take control of their retirement planning process.

Moreover, NewRetirement’s platform is also interactive, engaging, and user-friendly. It breaks down complex financial concepts into easy-to-understand terms, making retirement planning more accessible and less intimidating for everyone. Users can explore different strategies, compare options, and learn about best practices for retirement planning at their own pace. They can also track their progress over time and receive personalized recommendations on how to optimize their plans.

In addition to its robust toolset, NewRetirement also offers expert advice and educational resources to further assist its users. It hosts webinars, publishes articles, and provides access to a community of peers and professionals who can share insights and experiences. This wealth of information helps users stay informed about the latest trends and developments in retirement planning, allowing them to make well-considered decisions.

Furthermore, NewRetirement’s holistic approach extends beyond the individual level. The company believes in fostering a culture of preparedness and proactiveness when it comes to retirement planning. It advocates for more transparency, inclusivity, and fairness in the financial industry and pushes for policies that support the financial wellbeing of all individuals.

In conclusion, NewRetirement’s holistic approach to retirement planning is a breath of fresh air in an industry that often overlooks the non-financial aspects of retirement. By integrating financial planning with lifestyle, health, and personal goals considerations, the company is helping individuals create comprehensive and personalized retirement plans. With its innovative toolset, expert advice, and educational resources, NewRetirement is paving the way for a revolution in retirement planning.

Comprehensive Tools: What Sets NewRetirement Apart?

NewRetirement is distinguished by its comprehensive toolset, designed to assist users in planning and managing their retirement with ease and precision. What sets NewRetirement apart from its competitors is the depth and breadth of its resources. The platform offers a wide array of calculators, detailed financial planning tools, and personalized advice that cover a broad spectrum of retirement-related topics. From income and investments to healthcare and estate planning, NewRetirement provides a holistic approach to retirement planning.

The platform’s user-friendly interface is another defining feature. It provides easy navigation through complex financial data, enabling users to understand their financial situation better and make informed decisions. The tools offered by NewRetirement are not just about providing numbers; they aim to educate and empower users. They explain complex financial concepts in simple terms and guide users to make the best decisions for their retirement.

Another distinctive feature of NewRetirement is its personalized approach. The platform understands that every individual’s retirement journey is unique. Therefore, it offers personalized advice based on users’ specific financial situations and retirement goals. This ensures that users get the most relevant and effective solutions for their needs.

Also, NewRetirement takes security very seriously. It uses state-of-the-art security measures to protect users’ sensitive information. This commitment to security gives users peace of mind and confidence to use the platform’s tools and resources without worry.In conclusion, NewRetirement stands out for its comprehensive tools, user-friendly interface, personalized advice, and strong security measures. It is a platform that truly caters to the various needs of individuals planning for retirement, making it a top choice for many.

Integrating Financial Wellness: Key Features of the Holistic Approach

Integrating financial wellness into an individual’s life or a corporation’s strategy requires a holistic approach that extends beyond mere numbers. This comprehensive method addresses multiple dimensions of finance, such as budgeting, saving, investing, and retirement planning. It emphasizes the importance of understanding and managing one’s financial resources to achieve overall well-being and economic stability. Key features of this approach include personalized financial planning based on individual needs and circumstances, continuous education and guidance on financial matters, and accessibility to tools and resources that enable informed financial decision-making.

The holistic approach also promotes behavioral change by encouraging healthier financial habits and attitudes. It fosters resilience in the face of economic challenges and stresses the importance of preparedness for unforeseen financial emergencies. Moreover, it incorporates elements of physical and mental health as they often directly impact financial wellness.

Consequently, this comprehensive perspective on financial wellness can result in improved productivity, reduced financial stress, and enhanced quality of life. It can also lead to better financial outcomes and greater economic prosperity in the long run. Therefore, the holistic approach to financial wellness is not just about managing money but also about achieving a balanced and fulfilling life.

User Experience: How NewRetirement Simplifies Planning

NewRetirement is an innovative platform that has revolutionized the approach to retirement planning by prioritizing user experience. This digital tool simplifies the often complex process of retirement planning by providing an easy-to-navigate interface, allowing users to efficiently manage their finances and plan for the future. The platform is designed to be user-friendly, with clear instructions and intuitive controls, minimizing the potential for confusion or mistakes.

The technology uses data analytics and predictive modeling to provide personalized insights and options for each user, based on their unique financial circumstances and retirement goals. This personalized touch makes the process more engaging and less intimidating, reducing the stress often associated with planning for retirement. Furthermore, NewRetirement provides educational resources and tools to help users understand different aspects of retirement planning, empowering them to make informed decisions.

The platform also offers a suite of interactive tools, such as retirement calculators and budgeting tools, that enable users to visualize their financial future and adjust their plans as needed. This combination of simplicity, personalization, and education makes NewRetirement a valuable tool for anyone seeking to plan for their retirement with ease and confidence.

Expert Insights: The Future of Retirement Planning

The future of retirement planning, according to expert insights, will be significantly influenced by numerous factors, including changing demographic patterns, technological advancements, and shifts in economic landscapes. It is anticipated that the concept of retirement will be dramatically transformed over time as life expectancy continues to rise, and the traditional model of working for a fixed number of years, then retiring to a life of leisure, is increasingly becoming outdated. Instead, retirement is more likely to become a phase of life where people continue to work, but in a more flexible and less strenuous manner.

Additionally, the role of technology in retirement planning cannot be underestimated. Fintech solutions are already disrupting the sector, providing tools that simplify the planning process, increase accessibility and affordability, and offer personalized advice. Artificial intelligence and machine learning, in particular, are expected to revolutionize the way individuals plan for their retirement, allowing for more accurate forecasting and effective management of retirement funds.

Furthermore, shifting economic landscapes will also impact retirement planning. Economic uncertainties, including recessions, changes in monetary policy, and market volatility, will necessitate the need for more robust and adaptable retirement strategies. These trends, combined with other factors such as changes in government policies and societal attitudes towards retirement, will undoubtedly shape the future of retirement planning. As such, individuals, financial advisors, and policymakers alike will need to stay abreast of these developments to ensure effective retirement planning strategies for the future.

Success Stories: Real-Life Impact of NewRetirement’s Methods

NewRetirement’s innovative approach has led to numerous success stories, demonstrating the real-life impact of their methods on individuals and families striving for a secure financial future. One such story features a middle-aged couple who, despite having a decent income, found it challenging to manage their finances effectively. NewRetirement’s comprehensive planning tools and resources guided them in mapping out a realistic retirement plan, helping them understand their current financial situation and the steps needed to reach their goals.

Another success story involves a single mother who was overwhelmed by her financial responsibilities. Utilizing NewRetirement’s techniques, she was able to organize her finances, prioritize her expenses, and create a feasible savings plan, which ultimately improved her financial stability and peace of mind. This not only provided her with a secure retirement outlook but also improved her day-to-day financial management.

A retiree who was unsure of how to manage his savings for a comfortable retirement life also benefitted from NewRetirement’s methods. Through the platform’s easy-to-use tools, he gained insights into the most effective ways to manage his savings and investments, ensuring a steady income stream in his retirement years. This has allowed him to enjoy a worry-free retirement with the confidence that his finances are in order.

In each of these success stories, NewRetirement’s methods have had a profound real-life effect, transforming financial uncertainties into clear, actionable plans. These individuals and families not only achieved their financial goals but also gained financial literacy, empowering them to make informed decisions about their financial futures. With its user-friendly tools and resources, NewRetirement continues to make significant strides in revolutionizing retirement planning, making it accessible, understandable, and achievable for everyone.